Routing #313186909

Phone # (979) 316-4833

Locations + ATMs

Find Us

Drive Thru Hours

Mon-Fri: 9am-5pm

Lobby Hours

Mon-Fri: 9am-5:30pm

979-316-4833

Routing Number

313186909

Routing #313186909

Phone # (979) 316-4833

Locations + ATMs

Drive Thru Hours

Mon-Fri: 9am-5pm

Lobby Hours

Mon-Fri: 9am-5:30pm

979-316-4833

Routing Number

313186909

Here are a few highlights you won’t want to miss while browsing Kid’s Clubhouse.

And who can become a member of Old Ocean Federal Credit Union?

Would you like to learn how to "make change"?

We will show you how dividends are earned and interest is paid.

Play a game with the credit union words you just learned.

Many people save their money in a credit union. These people usually have something in common, such as their place of work.

The credit union’s main purpose is to give member-owners the best banking services. Old Ocean Federal Credit Union thinks that it has chosen a not so impossible mission.

Old Ocean Federal Credit Union pays you extra money for keeping the money you save in your account. This extra money is called “dividends.” The amount of dividends your account earns determines how quickly your money grows.

At the end of 1 year your $100 earned $2.50 in dividends.

At the end of 1 year $1,000 earned $25.00 in dividends.

The example below helps to explain how credit unions can pay you dividends and earn money, too.

Interest rate – 2.5%

| Info | Amount |

|---|---|

|

Info

Money on deposit

|

Amount

$100

|

|

Info

Interest @ 2.5%

|

Amount

$5

|

|

Info

Total in account

|

Amount

$105

|

Principal* $80 | Interest rate 10% | Time to repay 1 year

| Info | Amount |

|---|---|

|

Info

Principal

|

Amount

$80

|

|

Info

Interest @ 10%

|

Amount

$8

|

|

Info

Total to be paid

|

Amount

$88

|

| Info | Amount |

|---|---|

|

Info

Interest received from loan

|

Amount

$8

|

|

Info

Dividends paid to share holder

|

Amount

$5

|

|

Info

The amount that pays expenses

|

Amount

$3

|

**Expenses are: salary to employees, supplies, etc.

*The principle is the amount of the loan without the interest added.

The examples above were calculated in simple interest.

A budget is a way to keep track of your money.

With careful budgeting, you can save for the things you want,

instead of waiting to find out if you’re going to get them on your birthday or the holidays.

| Income Type | Amount |

|---|---|

|

Income Type

Allowance

|

Amount

$5

|

|

Income Type

Money earned walking the dog

|

Amount

$3

|

|

Income Type

Earned money from paper route

|

Amount

$10

|

|

Income Type

Money earned recycling cans

|

Amount

$7.50

|

| Income Type | Amount |

|---|---|

|

Income Type

School supplies

|

Amount

$3

|

|

Income Type

Baseball cards

|

Amount

$2

|

|

Income Type

3 packets of bubble gum

|

Amount

$.75

|

|

Income Type

Chipped in with Mom for Dad's birthday present

|

Amount

$5

|

|

Income Type

Deposited into account

|

Amount

$5

|

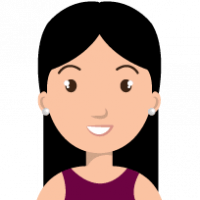

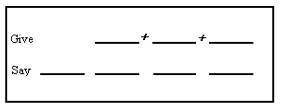

People who work with cash all the time, like tellers at Old Ocean Federal and cashiers at a store, use a special way to make change very fast. It’s a lot faster than writing with a pencil on paper or even looking at a cash register. Here’s how it works:

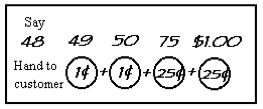

OK, let’s try it again, but with bills larger than one dollar. (Remember to count single bills until you get to the bill given.) Suppose the local video store is having a sale on previously viewed videos. Penny Wise wants a tape that they are selling for $7.38. She gives the cashier $10.00 for it. How does the cashier make change?

It’s best to count each coin and bill total out loud.

Please note: To make the questions easier, we have not included tax to the total of the sales.

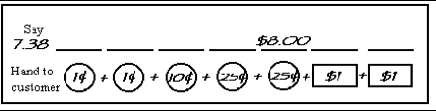

At your Garage Sale, you sell the video game you no longer play to Dolly Bill for $4.89. She gives you $10.00. How much change should you give her? Remember: Don’t use five singles when you can use one $5.

Following the instructions, cross off words in the diagram. When you are finished, the remaining words will form a message reading left to right, line by line. Some words may be eliminated by more than one of the instructions.

| 1 | 2 | 3 | 4 |

|---|---|---|---|

|

1

CARRY

|

2

IT

|

3

OWL

|

4

CHOIR

|

|

1

GOING

|

2

SWING

|

3

IS

|

4

IF

|

|

1

WINK

|

2

TO

|

3

BIG

|

4

OUTER

|

|

1

CROW

|

2

STILL

|

3

CHEER

|

4

MINDS

|

|

1

SEEK

|

2

SAVE

|

3

YOUNG

|

4

GREATER

|

|

1

ROBIN

|

2

LINK

|

3

OUR

|

4

CANAL

|

|

1

HIGH

|

2

RAVEN

|

3

YOUR

|

4

THAN

|

|

1

CREDIT

|

2

MOOD

|

3

RINK

|

4

THE

|

|

1

FUNNY

|

2

ATTIC

|

3

LOG

|

4

WHAT

|

Who knew being a kid could be such hard work? Book reports, math problems and science projects. But all work and no play makes for one really dull childhood. That’s where we would like to help. We’ve done your Web homework for you, studying up on the Net to bring you the best in A+ sites from around the world. Are we having fun yet? You bet! If only this week’s spelling test could be this easy.

Welcome to Old Ocean Federal Credit Union, proudly serving Sweeny, West Columbia, Brazosport, Old Ocean and all of Brazoria County, Texas. Here, you’re more than a customer. You’re a member and owner. That means we put you first, not fees or profits. It’s what sets us apart from banks and other lenders and why we’re confident you’ll love experiencing the credit union difference.

Old Ocean Federal Credit Union provides links to web sites of other organizations in order to provide visitors with certain information. A link does not constitute an endorsement of content, viewpoint, policies, products or services of that web site. Once you link to another web site not maintained by Old Ocean Federal Credit Union, you are subject to the terms and conditions of that web site, including but not limited to its privacy policy.

Click the link above to continue or CANCEL